Gross monthly income calculator hourly

Monthly Income Calculator Get a quick picture of estimated monthly income. Monthly and daily salary.

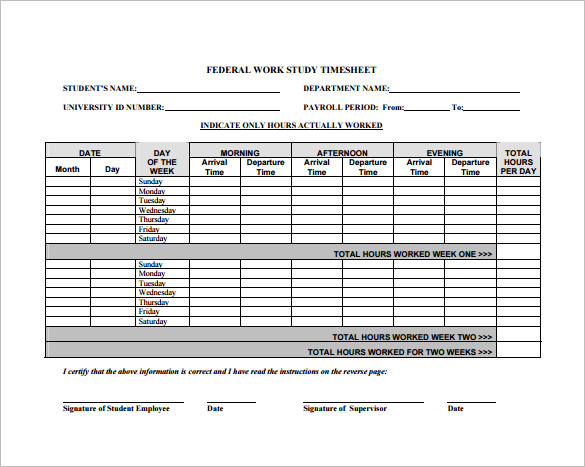

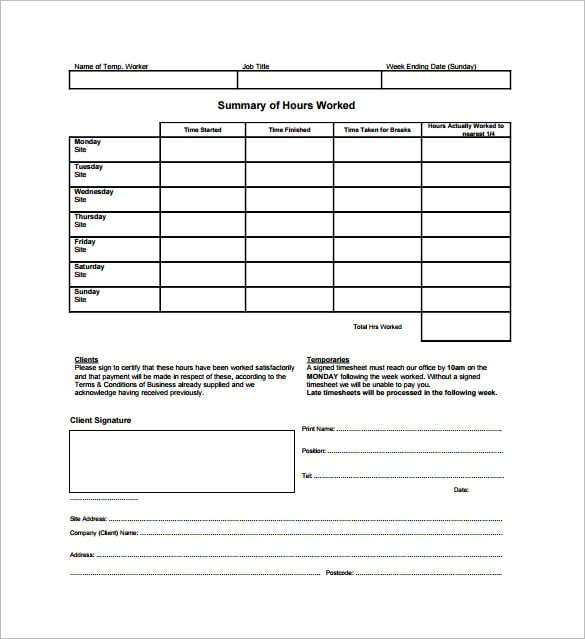

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paid a flat rate.

. If you are paid hourly multiply your hourly wage by the number of hours you work per week. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Multiply 188 by a stated wage of 20 and you get 3760.

To calculate the hourly rate of your earnings divide the total hours worked in a year by the annual earnings. Then she finds her annual salary by multiplying her weekly pay by 52. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

Daily wages are calculated using either the gross rate for paid public holidays paid leave. Standard Income Calculator Base Pay Calculator USPS Employee Calculator Year to Date Income Hire Date Last. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Gross Paycheck --Taxes-- --Details. 350 Dollars Per Week X 52 18200 Annual Salary. Money comes out of each of your paychecks throughout the year rather than you getting one giant tax bill in the spring.

Gross income per month Annual salary 12 To determine gross monthly income from hourly wages individuals need to know their yearly pay. This places Ireland on the 8th place in the International. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

You may receive a monthly or daily salary. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The algorithm behind this hourly paycheck calculator.

They can do so by multiplying. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Like federal income taxes Minnesota income taxes are pay-as-you-go.

If you have a monthly. Input this income figure into the calculator and select weekly for how often you are paid to. 225 Hourly Pay 125 In Tips 350.

45 000 - Taxes - Surtax - CPP - EI 35 57713 year net 35 57713 52 weeks 68418 week net 68418 40 hours 1710 hour net You simply need to do the same division for. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. How to calculate the hourly rate of salary.

Enter your info to see your take home pay. Or your hourly daily monthly and annual salary by considering how much you get paid and how much you work per day and week. Net weekly income Hours of work per week Net hourly wage Calculation example Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week.

Monthly salary A. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Your employer withholds a 62 Social Security tax and a.

In Minnesota your employer will deduct money to put toward your state income taxes.

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

How To Calculate Gross Income Per Month

Hourly To Annual Salary Calculator Online 58 Off Www Ingeniovirtual Com

Monthly Income Calculator Sale 58 Off Www Enaco Com Pe

Hourly Paycheck Calculator Calculate Hourly Pay Adp

My Salary Calculator Online 52 Off Www Ingeniovirtual Com

Salary To Hourly Calculator

What Is Annual Income How To Calculate Your Salary

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Calculating Income Hourly Wage Youtube

Pay Raise Calculator

How To Calculate Gross Income Per Month

Hourly To Salary Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary What Is My Annual Income

Overtime Calculator

Salary To Hourly Calculator